Let Your Money Outwork You.

Sound advice to grow and preserve your wealth and relationships.

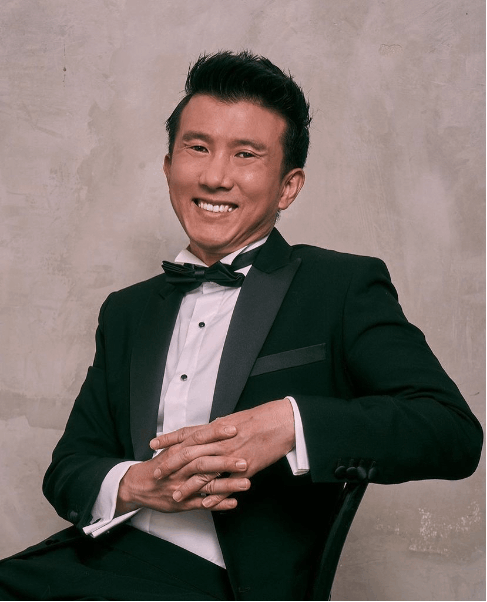

MK Lau

Million Dollar Round Table Award Qualifier

“Wealthy families remain wealthy because of a system of wealth preservation and distribution; not because of a single high-income earner.”

Career

Let’s grow your career together.

I’m looking for amazing people (like you) who desire high performance at work and in life. If you’re ready to help millions of respected individuals to grow their wealth, you’ve come to the right place.

About MK

8 time Million Dollar Round Table (MDRT) 2014 - 2022& Court Of Table (COT) Qualifier 2017

MK is a multi-award winning wealth advisor with AIA. MK believes in Mpowering his clients through integrated wealth management advisory .

An aspiring triathlete and a father of two, MK measures wealth by freedom and time. The former banker moved into the wealth advisory space so as to better represent his clients who have trusted him to act completely in their interest.

Our Services

Portfolio Spotlight Consultation

Successful professionals have often discovered the secrets to success and are focused on acquiring even more.

The Portfolio Spotlight Consult is designed to shed light on certain blindspots, one might have in their wealth management and estate planning strategies. In doing so, we aim to help successful professionals ensure that they do not become victims of their own success.

Automated

Real-time

User-Driven

Interactive

Inter-Generation Advisory Service

“Wealth does not last beyond three generations.”

Is that true or is that true only for those who believe in it? Each family is unique and has its own unique set of challenges and relationship dynamics.

How can families overcome their own inertia and design a wealth plan that preserves the sacrifices of all generations?

This service supports your legacy of your family’s wealth to persist despite the odds.

- Cost-Saving Analytics and Recommendations

- Customizable Customer Feedback Loop

- Collaborative Idea Platform

- Progressive Roadmap Transparency

Personal and Business Risk Consultation

Growing a business is a worthy challenge. It comes with its own challenges, risks and reward.

As with all endeavours, journeys can be interrupted by both internal and external forces such as death, disability or even debilitating diseases.

MK taps on his experience as an advisor to support your risk mitigation and personal-professional segregation strategies for your life and business endeavours.

- Automated Document Validation

- Integration with Third-Party Data Sources

- Self-Service Portal for Vendors

Areas of Expertise

Past Achievements

MK is a multi-award winning wealth advisor with AIA. MK believes in Mpowering his clients through integrated wealth management advisory .

An aspiring triathlete and a father of two, MK measures wealth by freedom and time. The former banker moved into the wealth advisory space so as to better represent his clients who have trusted him to act completely in their interest.

8 time MDRT

Standard Chartered Bank

AIA

Court Of Table

Singapore Standard Chartered

Xiamen China

Bintan

Vietnam

Our Blog

We bring the right people together to challenge established thinking and drive transformation.